when will the 8915 e tax form be available

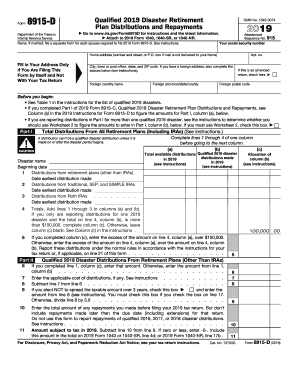

If you are not required to file an income tax return but are required to file Form 8915-E fill in the address. The form was initially launched in 2020 to meet the qualified disaster treatment of people who provide repayments on a three.

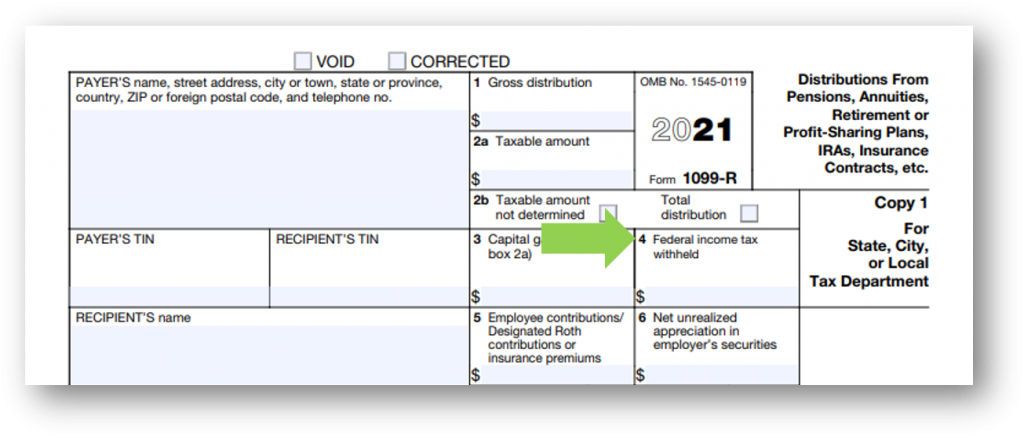

Tax Form Focus Irs Form 1099 R Strata Trust Company

More help with Form 8915-E.

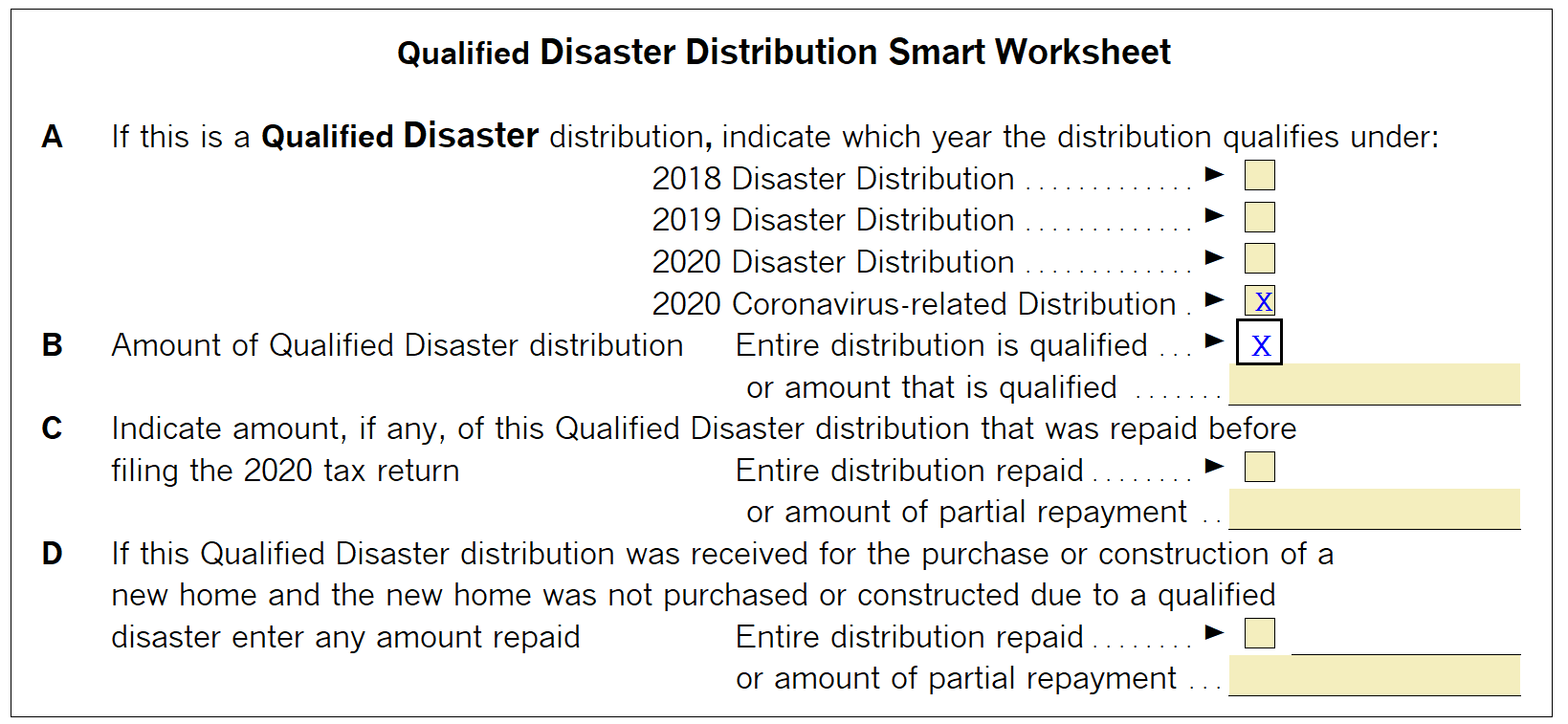

. Use Form 8915-E if you were adversely affected by a qualified 2020 disaster or impacted by the coronavirus and you received a distribution that qualifies for favorable tax. The information from Form 8915-E and 8915-F will be e-filed with the tax return as an IRS approved statement. Fill Out Form 8915-F for the tax year 2022.

When will Form 8915-E be available. The IRS created new Form 8915-F to replace Form 8915-E. The form is now available on the IRS site but its availability on TurboTax has created ambiguity among the people.

File 2020 Form 8915-E with your 2020 Form 1040 1040-SR or 1040-NR. Generating the 8915-F in ProSeries 2021. The form was scheduled to be released on 24th March 2022 on TurboTax.

Recently many people have found their lives upside down out of work. When Will Form 8915-e Be Available For 2021. For those of us who took retirement distributions due to COVID-19 in 2020 and chose to pay taxes over 3 years form 8915-E should again be used for the 2021 tax year for.

Form 8915-F is now. In 2021 the form was available around February 26 2021. This form will be used for anyone who chose to take a distribution from their retirement and spread the taxable amount over three.

If you think you qualify for a qualified. The 8915-E form is currently available to all American taxpayers.

Generating Form 8915 In Proseries

Reminder Due Dates For 2020 Tax Returns And The Change Of Tax Day To May 17th Wegner Cpas

1040 1099 R Distribution Amounts Doubling 1099r

10 8915 D Images Stock Photos Vectors Shutterstock

Irs Faqs Clarify Coronavirus Related Retirement Plan Relief

File Online 3 Steps To 100 Free Tax Preparation

Tax Form Focus Irs Form 1099 R Strata Trust Company

Publication 590 B 2021 Distributions From Individual Retirement Arrangements Iras Internal Revenue Service

How To Report 2021 Covid Distribution On Taxes Update Form 8915 F Youtube

8915 D Form Fill Out And Sign Printable Pdf Template Signnow

Use Form 8915 E To Report Repay Covid Related Retirement Account Distributions Don T Mess With Taxes

Taxes On Cares Act Ira Withdrawals Form 8915 E Youtube

What You Need To Know About Coronavirus Related Distributions Before Filing Your 2020 Tax Return

M O Cpe The Definitive Tax Seminar

Camp Lejeune Camp Lejeune Tax Center Opens Monday The Tax Center On Camp Lejeune Will Open On Monday Jan 25 To Assist Service Members Families And Retirees Prepare Their 2020 Taxes

A Guide To The New 2020 Form 8915 E

Retirement Account Covid Relief What We Know So Far

Irs Issues Guidance For Coronavirus Related Distributions And Loans From Retirement Plans Under The Cares Act Maynard Cooper

How To Pay Taxes Over 3 Years On Cares Act Distributions Tax Form 8915 E Explained Youtube